| What

is set forth on this page is but a tip of the iceberg of the

comprehensive laws of estate taxation. It is a mere glimpse

of some of the basic tax planning rules to reveal to you just

how important it is to get good legal advice to ensure you

minimize your estate tax bill.

The basic rules:

Federal Gift and Estate Tax Lifetime Credit for 2015:

$5.43mm/person. Over and above this lifetime credit, a

gifter may gift any numerous people what is call the annual

exclusion amount, which is $14,000/per gifter/per donee.

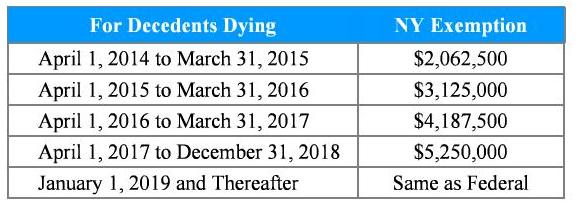

Please be aware, that there is a separate New York

Estate tax that is in effect, over and above the Federal

Estate tax.

But...there are ways to give way more during your lifetime

Of course, to every basic rule, there is an exception,

here are a few:

- $14,000 exclusion. Every year, a person may give any

number of people $13,000 each. Jointly, a married couple

may give each person $26,000. The benefits include reduction

of your taxable estate, and this $13,000 does not use

up any of your lifetime credit.

- Spousal Allowance. If your spouse is a United States

citizen, you may give your spouse thousands, millions

or billions of dollars tax free. Again, this does not

use up any of your lifetime credit. The problem arises

when your spouse dies, and the money goes to others. The

money will be fully taxable. ** Speak to an attorney if

your spouse is not an American citizen, special rules

apply.

- If your estate is greater than the credit allowed, it

would be wise to divide your assets between you and your

spouse, held in separate names, so you can utilize and

maximize each of your lifetime credits.

- Charitable Allowance. You can give an unlimited amount

of money to charities tax-free. Your attorney will advise

you as to whether your charity is a tax-exempt corporation

which allows deductibility.

- Start a trust for the benefit of your children or grandchildren's

health, education, maintenance and support.

- Pay for any person their medical, dental, tuition or

rent bill, PROVIDING, you pay directly to the provider

and not to the beneficiary

There are other means and variations of the above which

will help you accomplish your goals. Your attorney will

help you based on your special facts and circumstances.

Helpful Links

New York State Tax Forms:www.tax.state.ny.us/forms

Internal Revenue Service Tax Forms:www.irs.gov/forms_pubs

Definitions:

Taxable Estate:

That property which is subject to taxes. Please understand

that even if you did not have a probate estate, your estate

can still be a taxable estate. It includes, among other

things, property which was held jointly, insurance policies,

houses, bank accounts, brokerage accounts and gifts that

were given by the deceased person within three years of

his death.

bullet

Probate Estate: Only that property which

the decedent owned in his own name only, or as a tenant

in common with someone else. Those assets held jointly with

the right of survivorship or by the entirety (special only

to married couples), by operation of law automatically run

to the joint owner, and need not go through probate. Please

note that although said joint property does not have to

go through probate, the entire value of the joint property

is placed as if the first to die owned it entirely and taxes

have to be paid on the entire value of the asset.

bullet

Lifetime estate tax credit: It is the

total amount of money which the government allows you to

transfer in your lifetime and at death tax-free.

bullet

Stepped up basis: The fair market value

of the decedent's assets as of the time of his death, versus

the value of the assets at the time the decedent purchased

said assets or was gifted said assets.

Go to the top of the

page |